IQOS in the U.S.

Examining the launch of the country’s newest electronic tobacco product

As e-cigarettes drive youth tobacco use to highs unseen in nearly two decades, a new electronic nicotine delivery device marketing itself as a high-tech, luxury product has entered the U.S. market. IQOS, the latest product from tobacco giant Philip Morris International (PMI), claims to be an innovative tobacco product that reduces exposure to chemicals by heating tobacco to produce a nicotine aerosol. In 2019, after years of regulatory debate, the Food and Drug Administration permitted the sale of IQOS, and in July 2020, the agency gave PMI the green light to market the product with the claim that it reduces a user's exposure to harmful or potentially harmful chemicals, but importantly did not authorize the claim that it reduces health risks associated with cigarette smoking. We are just beginning to see what these decisions might mean for public health in this country. To get a first look at potential implications, Truth Initiative researched IQOS marketing, including visiting the first U.S. stores selling the product, and analyzed information on who might be using IQOS. What we found was a carefully executed plan to present IQOS as the future of tobacco, complete with luxury stores, ads in high-end magazines, and a billion-dollar investment in “smoke-free” products — all designed to grow the market for nicotine with both new users and by keeping current smokers addicted to nicotine and using tobacco products.

Big Tobacco 2.0: IQOS and a new industry strategy

IQOS is part of a larger tobacco industry strategy to overhaul its reputation with novel products and electronic devices, including heated tobacco products and e-cigarettes. In “Spinning a new tobacco industry,” Truth Initiative exposes the industry’s tactics to rebrand its public image and position itself as working alongside public health, all the while continuing to expand its bottom line by continuing to market deadly combustible tobacco, expanding nicotine addiction and aggressively growing its market base among youth and young adults.

Read the report at https://truthinitiative.org/research-resources/tobacco-industry-marketing/spinning-new-tobacco-industry-how-big-tobacco-trying

IQOS’ DEBUT IN THE U.S.

IQOS debuted in 2014 in test markets in Japan and Italy and is currently available for sale in 52 countries. While IQOS is a Phillip Morris International product, it is licensed to be sold and marketed in the U.S. by Altria, PMI’s American counterpart. The first official IQOS store in the U.S. opened on October 4, 2019 in Atlanta, five months after the FDA permitted the sale of IQOS in the U.S.

The IQOS store is in Lenox Square Mall, a high-end shopping mall in the tony neighborhood of Buckhead, Atlanta. Like its international counterparts, the Lenox Square Mall store features a simple, elegant design and is decorated in a manner that evokes tech-savvy, high-end products like Apple.

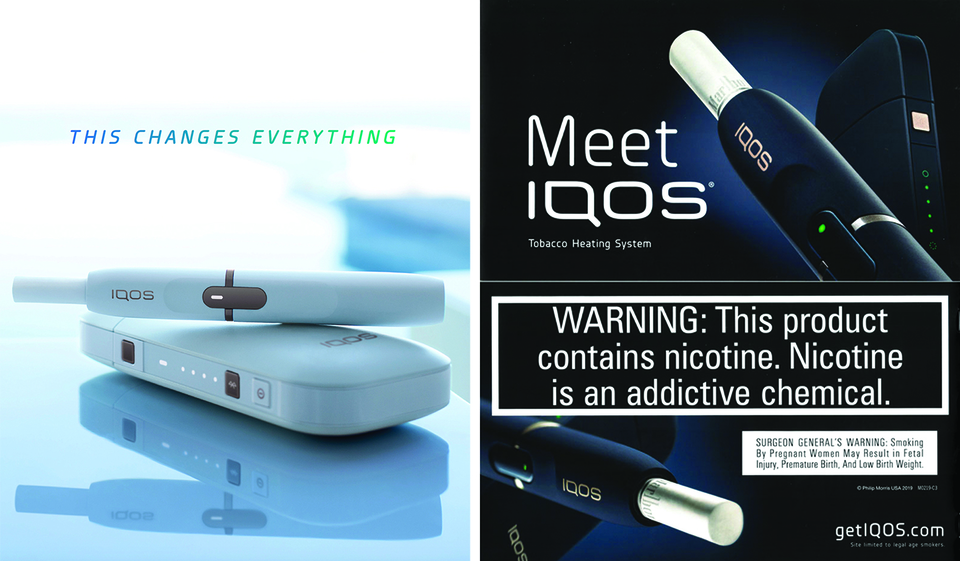

Advertising the launch: In advance of the store’s opening, PMI embarked on a deliberate marketing strategy, spending $1.29 million in fall 2019 alone to advertise IQOS. IQOS ads appeared exclusively in higher-end fashion and tech magazines, including GQ, Men’s Journal, Popular Science, Vogue and Wired, positioning IQOS as a premium product offering an innovative design.

Source: Stanford Research Into the Impact of Tobacco Advertising (SRITA) (tobacco.stanford.edu)

Magazine ads were minimalist and designed to introduce the product. The advertising campaign aimed to normalize IQOS use by depicting the product alongside coffee, alcohol and desserts as part of an everyday routine.

Source: Stanford Research Into the Impact of Tobacco Advertising (SRITA) (tobacco.stanford.edu)

Local public health advocates are aware of international marketing efforts targeting youth (See “IQOS abroad: Upscale lifestyle product marketed to youth,” page 6) and are wary of such tactics being instituted in the U.S. Shirley Borghi, executive director and vice chairman of the Hispanic Health Coalition of Georgia, is concerned that the new, sleek design of IQOS and its stores as well as the accessibility of heat sticks sold in local convenience stores will attract and keep urban and minority customers. “IQOS appears to be intentionally marketed as the latest accessory to match with one’s personal style,” Borghi said.

U.S. limits IQOS social media targeted to youth: While IQOS is permitted to market their product on social media, they are not allowed to target youth and the FDA has required Altria to provide information on steps it is taking to prevent youth exposure to social media advertising. IQOS launched social media profiles on Facebook and Instagram for its U.S. market in November 2019, using the accounts to promote its referral reward program, introduce product features and highlight store locations. The accounts have very small followings as of April 2020, with 308 followers on Instagram and 26 followers on Facebook.

Online interest growing: Online searches have gradually increased since November, with search queries related to the Atlanta store, online shop and IQOS airport lounges.

IQOS appears to be intentionally marketed as the latest accessory to match with one’s personal style

What is IQOS?

IQOS is a heated tobacco product created by Philip Morris International (PMI) and sold by Altria under a license from PMI in the U.S.

- Operated by inserting a tobacco stick into a device and heated to create an inhalable aerosol.

- Currently available in Atlanta, GA, and Richmond, VA. Charlotte, NC store scheduled to open in 2020.

- IQOS device and pack of 200 HeatSticks retails for at least $80.

Does IQOS reduce exposure to harmful components?

A systematic review found that, generally, tar and nicotine levels were lower among IQOS products than conventional cigarettes. However, some research has found similar levels. PMI's own data from clinical studies show that smokers who switched to IQOS did not improve in pulmonary inflammation or function. More research is needed before a conclusion can be reached. In July 2020, however, the FDA authorized PMI to market IQOS with the claim that switching completely from conventional cigarettes to IQOS reduces consumer exposure to harmful chemicals, even though most members of an official FDA advisory panel of external experts were skeptical of the claim. And because there is no evidence that IQOS reduces the risk for disease associated with smoking, the FDA rejected PMI’s other request to market IQOS as a reduced risk product.

Relative addictiveness to cigarettes and e-cigarettes is unclear

- IQOS HeatSticks contain more nicotine than a conventional cigarette, but IQOS aerosol only contains 57%-83% of the nicotine of a conventional cigarette.

- Nicotine levels in IQOS aerosol are higher than some of the older generations of e-cigarettes, but lower than the newer generations of e-cigarettes.

THE IQOS STORE EXPERIENCE

In fall 2019, the only way to purchase the IQOS device was by personally visiting a store in Atlanta or ordering online and picking up in- store. Subsequently, Altria has opened two flagship IQOS stores in high-end malls, seven mobile stores in convenience store parking lots and six pop-up stores (“IQOS Corners”) inside convenience stores in Atlanta. Truth Initiative staff members have reported that HeatSticks are also being sold in Walgreens, which recently announced that it would discontinue e-cigarettes sales. IQOS devices and accompanying HeatSticks retail for around $80. While the initial purchase price of IQOS is higher than other tobacco products, it is important to note that PMI has employed promotional price strategies in the past to lower prices. Once users own an IQOS device, purchasing additional HeatSticks (which retail for $5.75/pack of 20) is relatively cheap and Altria is actively working to get some states to give HeatSticks a beneficial tax treatment to reduce the price of the product to make it more attractive.

To get a glimpse of the first U.S. stores, a team of four Truth Initiative staff and affiliates individually visited the IQOS store in Lenox Square Mall and the IQOS inside a RaceTrac gas station in Smyrna, GA, to understand how the stores operated.

When IQOS opened its doors in Atlanta in October, sales were supposed to be limited to those 21 and over but the policy was inconsistently enforced. While visitors’ driver’s licenses were scanned and personal information collected at the IQOS store in Lenox Square Mall, a 21-year-old visitor to the RaceTrac convenience store was not asked for ID until the end of her visit. The stores also charged $1 to sample IQOS, a technique the industry uses to get around regulations banning free samples.

In-store experiences were designed to project a positive image: Visitors across the board described sales staff they encountered at the stores as friendly, knowledgeable, and laid back. More than one visitor compared the look and feel of the IQOS store to a small Apple store. During their visits, they were told that IQOS was designed for people to switch from traditional cigarettes, that traditional smokers rather than e-cigarette users would be more likely to enjoy IQOS without the unknown risks of vaping, and that IQOS was a safer alternative to smoking — a marketing claim that IQOS was not allowed to legally make (see: The Road Ahead, p.8). All visitors to the Lenox Square Mall store were asked about their smoking status, but no one verified smoking status at the Smyrna store.

IQOS abroad: Upscale lifestyle product marketed to youth

IQOS is available for sale in 52 countries around the world, where it is marketed as a youthful, upscale lifestyle product with ads featuring attractive young models. For example:

- PMI has used influencers on social media to target young people. Social media posts using #iqos have been viewed 179 million times on Twitter and Instagram between March 20, 2018 to March 20, 2019.

- IQOS was featured at youth events associated with Romania’s “BeLikeMe” campaign, which asked “IQOS Consultants” to promote the product at parties, festivals, and retail locations.

- In South Korea, 40% of young adults between the ages of 19-24 were aware of IQOS three months after its introduction.

- IQOS use rates increased 10-fold among young adults in Japan between 2016 and 2017, credited to PMI introducing the product on a well-known television program.

Sales staff positioned IQOS as a safer alternative to smoking, according to a 30-year old former smoker and current vaper.

A 21-year-old visitor to the Smyrna store who hadn’t previously used tobacco said, “The experience was extremely informative and if I was on the fence about the product, after the conversation, I’d immediately make the purchase.” She described the sales staff as friendly and knowledgeable, and said that their approach would make anyone in her age bracket extremely interested in trying the product. She recounted that sales staff described IQOS as a complement to cigarettes: “The description made me feel like I wouldn’t be doing anything wrong at all. I wouldn’t have to worry about the negative effects of JUUL or JUUL-like products. I’d only be getting the tobacco sensation I was aiming for.” The sales representative then attempted to recruit this 21-year-old visitor, who had never used tobacco, by giving her two business cards for “IQOS Experts,” saying she could contact them to join the marketing team. Such tactics are not surprising — young people with large social networks have been the backbone of recent tobacco campaigns like JUUL.

A 30-year old former smoker and current vaper reported that everyone he spoke to who worked in the Lenox Square Mall store said that they were an ex-smoker who had taken up IQOS. Sales staff during his visit positioned IQOS as a safer alternative to smoking, and “without the unknown risks of vape pens and the like.”

Visitors to the Atlanta stores received follow-up emails promoting IQOS and announcing a rewards program for customers to exchange points for product coupons. These emails highlighted a new “hi-tech tobacco experience.”

Who’s using IQOS?

Heated tobacco products (HTP) have been on the U.S. market since 1996.

- HTP use remains low but has grown since 2016: ever use of other HTPs (e.g. Eclipse, Accord) increased from 1.4% > 2.2% (2016- 2017); current use increased from 0.5% > 1.1%.

- IQOS is just beginning to emerge in sales data in its test markets: IQOS sales represented 0.02% of total sales of all cigarettes in both the Georgia and Virginia test markets in March 2020. Sales grew by 20% in Georgia and 30% in Virginia between February and March 2020.5*

- Males, current tobacco users, and current e-cigarette users are more interested in using IQOS.

- <1% of young people aged 15-24 in a 2020 national survey (n=2,600) had ever tried IQOS. Most users are between ages 18-24.

- Around 20% of youth who had never tried tobacco products expressed interest in IQOS, and one in three were considered susceptible to trying the product in 2020.

*The conclusions drawn from the Nielsen data are those of the researcher(s) and do not reflect the views of Nielsen. Nielsen is not responsible for, had no role in, and was not involved in analyzing and preparing the results reported.

PMI SEES POTENTIAL IN YOUNG, FORMER VAPERS AND “SMOKE-FREE” MARKET

The development and retail plan for IQOS relies on two companies: PMI and Altria. While they are two separate companies, PMI was an operating company of Altria’s until 2008 when Altria spun off PMI, clearing PMI from legal and regulatory constraints in the U.S. The companies considered reuniting under a new merger but this is now believed to be less likely in the near future given Altria’s investment in JUUL.

Both companies have a vested interest in expanding the tobacco product market and have touted their efforts to create non-cigarette tobacco and nicotine options, including IQOS. In 2019, PMI granted an exclusive license to Altria to market IQOS in the U.S.

Altria has stated that it believes that being made of real tobacco will give the product advantages compared to vape products and the fact that it has already gone through a lengthy two-year process with FDA to obtain approval will give it a headstart against competitors. Altria has also stated that it believes former vapers and menthol smokers are a big opportunity. This is noteworthy given that both vaping and use of menthol are entry pathways for young users of nicotine.

For its part, PMI has invested $7.2 billion in developing “smoke-free" products in the hopes of receiving about 40% of its revenue – nearly $20 billion – from non-combustible and other novel tobacco products by 2025.

FDA authorized PMI to market IQOS with the claim that switching completely from conventional cigarettes to IQOS reduces consumer exposure to harmful chemicals, even though most members of an official FDA advisory panel of experts were skeptical of the claim.

THE ROAD AHEAD: FDA GREEN LIGHTS IQOS AS A “REDUCED EXPOSURE” PRODUCT

As PMI sought its initial premarket authorization to legally sell IQOS in the U.S. without being able to make any claims in regard to its relative risk versus cigarettes, PMI simultaneously applied to the FDA to market IQOS as a modified-risk tobacco product (MRTP). In July 2020, the FDA authorized the marketing of IQOS with the reduced exposure claims below:

- The IQOS system heats tobacco but does not burn it.

- This significantly reduces the production of harmful and potentially harmful chemicals.

- Scientific studies have shown that switching completely from conventional cigarettes to the IQOS system significantly reduces your body’s exposure to harmful or potentially harmful chemicals.

IQOS DOES NOT REDUCE HEALTH RISKS ASSOCIATED WITH SMOKING

Notably, the FDA did not authorize IQOS to market itself as reducing health risks associated with cigarette smoking, saying there wasn’t enough evidence to support the claim. The concern is that users may assume that the permitted “reduced exposure” claim may translate to “reduced risk” and encourage IQOS use, especially among those who have not used nicotine products before.

IQOS’ relative safety is far from clear. A 2019 systematic review found that tar and nicotine levels were generally lower among IQOS products than conventional cigarettes, but some research has found that they have similar levels. PMI's own data from clinical studies show that smokers who switched to IQOS did not improve in pulmonary inflammation or function. More research is clearly needed before a conclusion can be reached.

REDUCED EXPOSURE CLAIM ONLY EFFECTIVE IF USERS COMPLETELY SWITCH FROM CIGARETTES

It’s also important to note that the “reduced exposure” claim permitted by the FDA applies to users who switch completely from conventional cigarettes to IQOS — not to those who use IQOS and traditional cigarettes at the same time, which is likely to happen. In the data that PMI provided to support its application, PMI considered users “switched” not if they exclusively used IQOS but if they used IQOS for 70% of their total tobacco use. Moreover, PMI’s claim that IQOS helps users switch from traditional cigarettes is unsupported by PMI’s own research showing that very few users actually completely switched and significant dual use (using both cigarettes and IQOS) remained. In fact, over 50% of users from PMI test studies in Japan still fell within PMI’s categories for dual-use and predominant cigarette use. The number was even higher (80%) in test markets in Switzerland. Research has shown that dual use is not associated with reduced cigarette use, but rather increased exposure and poorer health outcomes than using cigarettes alone. The FDA needs to monitor if users are indeed switching completely to IQOS to justify the reduced exposure claim.

YOUTH PERCEPTIONS AND IQOS INITIATION NOT ADDRESSED

The FDA authorized the marketing of IQOS as reduced exposure even though PMI failed to account for how IQOS might impact youth, offering no information in its application on how its promotional materials might impact youth perceptions and initiation. The FDA will continue to monitor the marketing of IQOS and its impact on the population and could determine that IQOS no longer benefits the health of the population as a whole, particularly if there is a significant increase in youth initiation or initiation by non-users.

Finally, PMI has revealed no plan to combat the population-level effects of menthol flavored HeatSticks. Given menthol’s role in youth tobacco initiation, it is critical for the FDA to closely examine the impact of menthol IQOS products.

The FDA stressed that its decision — which took nearly four years — does not grant IQOS FDA “approval” or mean that IQOS products are safe. It does, however, grant IQOS a marketing edge and headstart over other “alternative” cigarette products.

PMI’s claim that IQOS helps users switch from traditional cigarettes is unsupported by PMI’s own research showing that very few users actually completely switched and significant dual use (using both cigarettes and IQOS) remained.

BEYOND ATLANTA: ADDITIONAL U.S. STORES TO COME

A second U.S. store opened in Richmond, VA, on November 16, 2019 along with some pop-up kiosks. An article announcing the store opening refers to IQOS as an “alternative smoking device.” David Sutton, an Altria spokesman, told the Richmond Times-Dispatch, “For those who are interested in the product, we will begin them on a guided trial and conversion journey to fully convert to IQOS, which is our ultimate goal.” HeatSticks are available for sale in more than 500 retail stores across Atlanta and Richmond.

Altria is actively lobbying for laws that give its products, including IQOS, preferable tax treatment. For example, Virginia recently changed the definition of a cigarette in that state so that HeatSticks would not necessarily be considered cigarettes there (as they are federally). As such, it is unclear if HeatSticks are being taxed as tobacco products at all in Virginia.

Altria announced plans to expand to a third U.S. market, Charlotte, NC, in 2020 and to four more cities in the next year and a half, although Altria pushed back the Charlotte launch because of the COVID-19 outbreak. Willard, then Altria’s chairman and CEO, said during an investor conference, “Charlotte is a growing metropolitan region with a pro-harm-reduction legislative environment. In fact, North Carolina is one of five states that has enacted legislation to lower excise tax rates for products that receive a modified-risk claim from the FDA.”

FULL REGULATION AND CAREFUL MONITORING NEEDED NOW

The science on heated tobacco products like IQOS is far from settled, but independent research suggests caution. To date, 20 of 31 studies on heated tobacco products were funded by the tobacco industry. What we know from non-industry affiliated research is that the aerosols released by IQOS contain several of the same potentially harmful substances found in cigarettes. Research also suggests that IQOS could expose users to lower risks of some diseases, but higher risks of others. The FDA’s hesitation to allow IQOS to market the product as “reduced risk” speaks to the lack of scientific consensus around the issue.

Although IQOS use is currently low and its marketing strategy rather limited, now is the time to put appropriate guardrails in place to prevent its use by non-tobacco users, youth and young adults, and others at risk of persuasive advertising campaigns promoting IQOS as a “reduced harm” tobacco product.

- Federal and state regulations should include heated tobacco products. Strong tobacco control policies such as smoke-free laws, restriction of flavored products, including menthol, and tobacco taxes must cover HTPs to prevent the tobacco industry and its political allies from utilizing loopholes to exempt IQOS from regulations intended to minimize the harms of its use.

- The FDA should provide aggressive oversight and enforcement. FDA should continue to monitor IQOS marketing and its impact on the population, as promised in its recent authorization of IQOS as a “reduced exposure” tobacco product. Further, if FDA finds evidence of significant youth uptake or initiation by non-users, it should act quickly to remove the product from the market.

- Strict marketing guidelines must be enforced to prohibit advertising to youth, particularly social media advertising. While IQOS’ social media presence is currently limited in the U.S., it is critical to continue to monitor its use of youth-frequented platforms. We must not let another tobacco company seize the use of popular social media sites like Instagram in order to boost a new tobacco product. Strong post-marketing reporting requirements have been mandated by FDA and the agency must ensure that they are met. We have also expressed significant concern that marketing HeatSticks under the Marlboro name may increase the overall appeal of all Marlboro products, including cigarettes. We know that Marlboro tops the list of preferred cigarette brands among teenagers and has very high brand recognition.

- Stop normalization of tobacco products. The positioning of IQOS as a luxury product only available at high-end mall stores is problematic. Despite what PMI may say about it as a reduced exposure product, these advertising strategies appear to be aimed at elevating a tobacco product in the eyes of nonusers. The use of designer stores is likely only the beginning of a marketing strategy to elevate IQOS as a “cool,” “elite” product before expanding the availability to other stores nationwide. We can learn from our experience with JUUL and the rapid rise of e-cigarettes: flashy, persuasive, and manipulative advertising works and threatens to open a new front in the battle against tobacco use. IQOS is already here in the U.S. It is up to policymakers, public health advocates, and the general public to guard against what it could become.

To date, 20 of 31 studies on heated tobacco products were funded by the tobacco industry.

More in emerging tobacco products

Want support quitting? Join EX Program

By clicking JOIN, you agree to the Terms, Text Message Terms and Privacy Policy.

Msg&Data rates may apply; msgs are automated.