The price is not right

Majority of adults, and at least a quarter of current smokers, strongly favor efforts to raise tobacco prices

Most American adults want policies that raise the price of cigarettes and prevent discounting, according to a Truth Initiative survey that measures support for one of the most effective ways to reduce tobacco use. The survey also showed that while current and former tobacco users expressed lower levels of support, at least a quarter of current smokers and at least half of former smokers supported the policy options.

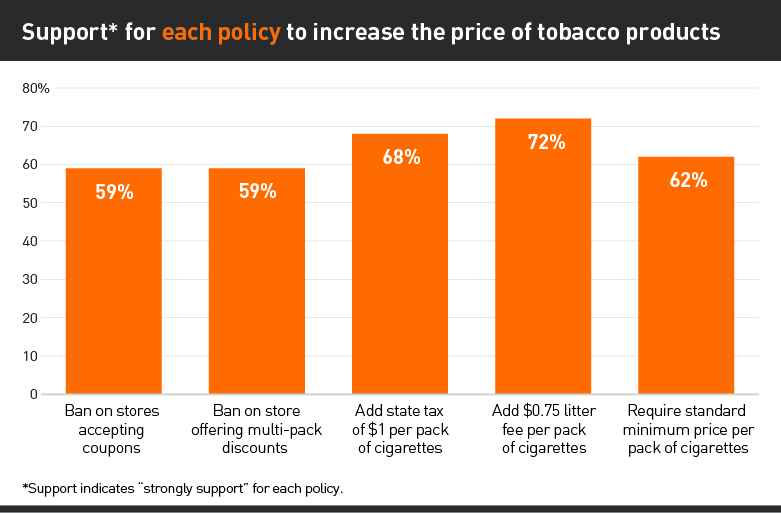

More than 6 in 10 adults support raising the prices of cigarette packs with an additional $1 state cigarette tax (67.5%), a $0.75 litter fee (72.2%), and a standard minimum price requirement (62.1%). A majority also want policies to prevent stores from accepting coupons (58.9%) or offering multi-pack discounts (58.9%), which would cut off the tobacco industry’s most popular marketing strategy: slashing prices with coupons and payments to sellers to offer discounts.

Research shows that higher prices help not only to decrease tobacco use, but also to increase quit attempts, and decrease the number of youth who start smoking. Increasing the minimum price of tobacco products, raising tobacco taxes or prohibiting retailers from accepting tobacco coupons also decreases their accessibility and appeal, especially among young people and those with lower incomes who are more sensitive to price increases.

There is a disconnect, however, between what research tells us works and the current policy environment regulating tobacco prices across the U.S. The U.S. Surgeon General recommends cigarette packs be sold at a price of $10 or higher, but the national average retail price of a cigarette pack, including a cigarette excise tax, is $7.05. Purchase prices are often much lower due to the billions of dollars that tobacco companies spend on price reduction strategies like multi-pack discounts and coupons to further cut costs. Last year, tobacco companies spent 92% of their marketing budget, at a cost of $7.73 billion, on these discount-related strategies. Clearly, the tobacco industry knows that price discounting strategies make a big difference when it comes to keeping price-sensitive populations addicted to their products.

The good news is that most adults, including those among price-sensitive populations such as young adults and low-income households, recognize the benefits of higher prices on tobacco products. A Truth Initiative survey found most U.S. adults support policy efforts to raise tobacco prices, with almost 60% supporting policies preventing stores from accepting coupons (e.g. $1 off a can of smokeless tobacco) or offering multipack discounts (e.g. buy three packs of cigars for the price of one) to lower the cost of tobacco products. Even more respondents supported policies like an additional state cigarette tax, a per-pack litter fee, and a standard minimum price for cigarette packs.

SUPPORT FOR MANY TYPES OF PRICE INCREASES

To understand the level of public support for raising tobacco retail prices, Truth Initiative conducted a nationally representative study of 2,748 U.S. adults ages 18-64. The online survey was conducted in fall 2018, and asked participants to rate how much they supported five proposed retail price policies on a scale from 1 to 4, with 1 indicating “strongly support” and 4 indicating “strongly oppose.”

The results of the study indicated widespread public support for policies increasing tobacco retail prices, including among price-sensitive groups. Over half of adults supported policies to prevent stores from accepting coupons (58.9%) or offering multi-pack discounts (58.9%). A greater proportion supported adding an additional $1 state cigarette tax (67.5%), adding a $0.75 litter fee (72.2%), and requiring cigarette packs be sold at a standard minimum price (62.1%).

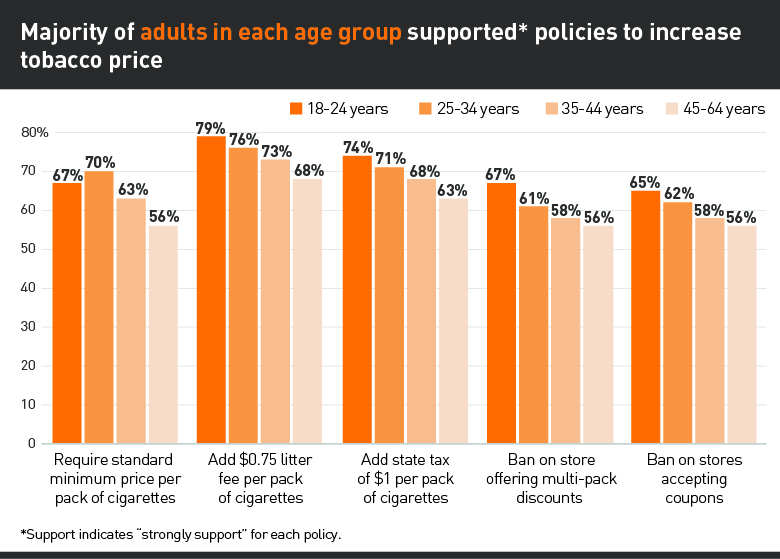

Younger participants (18-24 years old) expressed higher levels of policy support compared to older participants for four out of five policy proposals. In general, younger people have lower levels of disposable income and are less likely to start smoking or use tobacco as prices increase, meaning they are more sensitive to price changes than older populations.

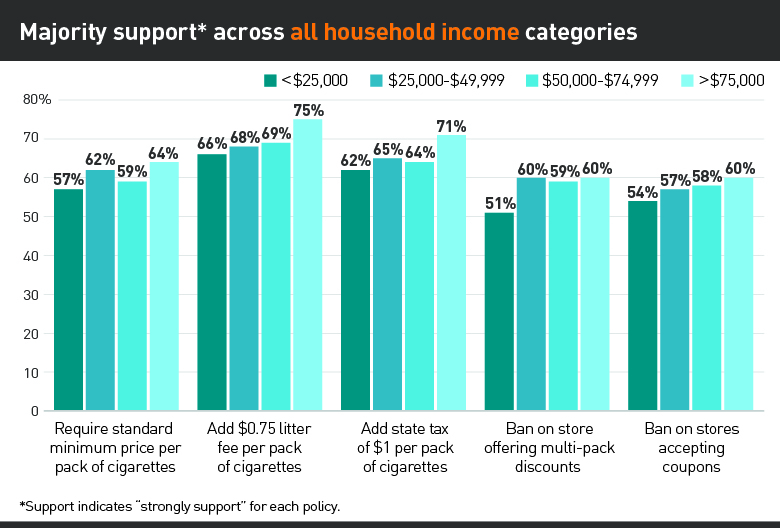

Lower income households are another segment of the population sensitive to price increases. Survey respondents from lower household incomes reported majority support for tobacco price policies. Additionally, support for nearly all policies increased with household income.

Support for tobacco price policy by other characteristics

- Tobacco users. While current and former tobacco users expressed significantly lower levels of support, at least a quarter of current smokers and at least half of former smokers supported the policy options.

- Political philosophy. The majority of survey participants supported policies to regulate tobacco price regardless of political philosophy.

- Tobacco control environment. Support was higher among participants living in states with more restrictive clean air policies and higher excise tax on cigarettes, suggesting that local tobacco control policies can increase support for even stronger policies to limit access to tobacco products.

POLICYMAKERS HAVE PUBLIC SUPPORT AND MUST ACT

Results from this survey make clear that the majority of U.S. adults want stronger tobacco retail price policies. With about 60% of adults supporting restrictions like litter taxes and minimum prices per pack, policy makers should feel emboldened to implement the policies that will discourage tobacco use and promote public health.

Tobacco price policies can also offset industry practices designed to undercut price regulations, such as price discounting strategies like coupons and multi-pack discounts. Tobacco companies know full well that price discounts and incentives drive tobacco consumption, discourage quitting, and encourage non-smokers and youth to try smoking. After all, tobacco companies spent 92% of their marketing budget, at a cost of $7.73 billion, on such tactics in 2018.

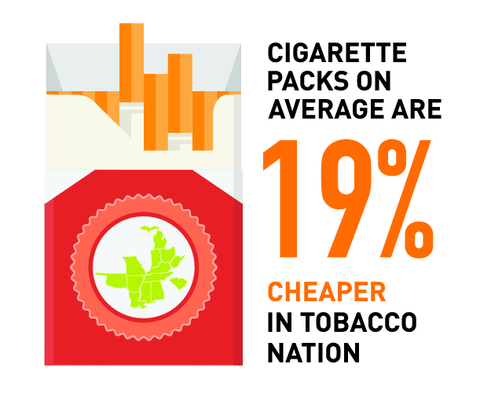

It’s not a coincidence that in Tobacco Nation, a collection of states where smoking rates exceed the national average and include Alabama, Arkansas, Indiana, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Ohio, Oklahoma, South Carolina, Tennessee, and West Virginia, cigarettes are also much cheaper: cigarette packs in these states are, on average, 19% cheaper ($5.69) than in the rest of the U.S. ($7.05), and the average tax on cigarettes ($1.07) is nearly half of the cigarette tax across the rest of the U.S. ($2.03).

State and local governments can raise tobacco prices by enacting some of the local tobacco pricing policies that garnered strong support, such as increasing state tobacco taxes or restricting multi-pack discounts on tobacco products. While many states and localities have enacted or are pursuing policies to increase the price of tobacco products, many have not. Currently, only 36 states, Washington, D.C., and three U.S. territories have a cigarette tax at $1 per pack or higher and only Connecticut, New York, Washington, D.C., Puerto Rico, and Guam have cigarette tax rates at $4 or higher. Very few states and localities have also enacted restrictions on accepting coupons or offering multi-pack discounts in the retail environment.

Raising the price of tobacco products is one of the strongest policy strategies to prevent youth and young adults from starting smoking and encourage smokers to quit.

Truth Initiative fully supports policies to discourage tobacco use, including retail price policies such as:

- increasing the price of tobacco products and setting minimum pack sizes,

- prohibiting discounting tactics such as couponing, buy-one-get-one free or multi-pack deals, and

- setting minimum prices for tobacco products.

Policymakers considering restrictions should also consider the differences in tobacco type; little cigars and cigarillos have lower pricing in youth-dominated and minority communities, and may benefit from stricter price regulations. Taxing the latest types of tobacco products like e-cigarettes can be an important strategy to dissuade youth tobacco use and fund tobacco control and health education efforts.

Raising the price of tobacco products is one of the strongest policy strategies to prevent youth and young adults from starting smoking and encourage smokers to quit. The effects of relatively modest policies can be tremendous: health economists have estimated that raising the cost of cigarettes to $10 per pack nationwide would result in 4.8 million fewer smokers between the ages of 12 and 25.

Enacting these policies will help prevent youth from starting to use tobacco and decrease cigarette use among populations vulnerable to tobacco use. With demonstrated effectiveness and widespread support for tobacco control policies, the burden lies with states and localities to enact lifesaving policies to protect their citizens from tobacco and improve the health of future generations.

For more information, see Truth Initiative’s point of sale policy resource and tobacco taxes policy statement.

More in tobacco prevention efforts

Want support quitting? Join EX Program

By clicking JOIN, you agree to the Terms, Text Message Terms and Privacy Policy.

Msg&Data rates may apply; msgs are automated.