Tobacco use in Ohio 2019

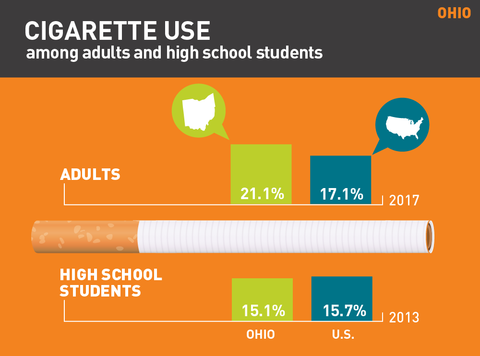

Cigarette use: Ohio

Cigarette use in Ohio

- In 2017, 21.1% of adults smoked. Nationally, the rate was 17.1%.1

- In 2013, 15.1% of high school students in Ohio smoked cigarettes on at least one day in the past 30 days. Nationally, the rate was 15.7%.2

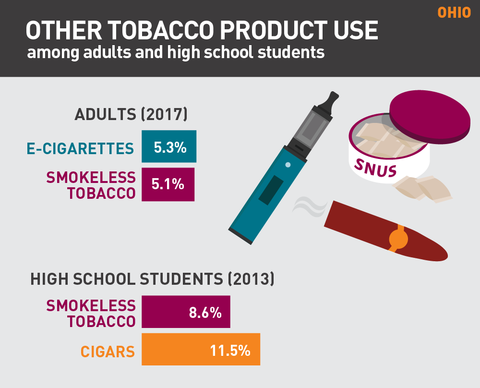

Other tobacco product use: Ohio

E-cigarette and smokeless tobacco use in Ohio

- In 2017, 5.3% of adults used e-cigarettes and 5.1% used smokeless tobacco.3

- In 2013, 8.6% of high school students in Ohio used chewing tobacco, snuff or dip on at least one day in the past 30 days. Nationally, the rate was 8.8%.2

- In 2013, 11.5% of high school students in Ohio smoked cigars, cigarillos or little cigars on at least one day in the past 30 days. Nationally, the rate was 12.6%.2

Economics of tobacco use and tobacco control

Economics of tobacco use in Ohio

- Ohio received $1.2925 billion (estimated) in revenue from tobacco settlement payments and taxes in fiscal year 2019.4

- Of this, the state allocated $13 million in state funds to tobacco prevention in fiscal year 2019, 9.8% of the Centers for Disease Control and Prevention’s annual spending target.4

- Smoking-caused health care costs: $5.64 billion per year.4

- Smoking-caused losses in productivity: $5.88 billion per year.5

Ohio tobacco laws

Cigarette tax in Ohio

Tobacco taxes

- Ohio is ranked 27th in the U.S. for its cigarette tax of $1.60 per pack (enacted September 2009), compared to the national average of $1.81. (The District of Columbia has the highest tax at $4.50 and Missouri has the lowest at 17 cents.)6-8

- Little cigars are taxed at a rate of 37% of the wholesale price. Premium cigars are taxed at the lesser of 17% of the wholesale price or 50 cents per cigar, plus a specified tax adjustment factor applied annually. All other tobacco products are taxed at a rate of 17% of the wholesale price.6,7

Clean indoor air ordinances

- Smoking is prohibited in government workplaces, private workplaces, schools, childcare facilities, restaurants, bars, casinos/gaming establishments, retail stores and recreational/cultural facilities.6,7

- The use of e-cigarettes is prohibited at the state capitol buildings and in body art establishment rooms used for body art or sterilization procedures.9

Youth access laws

- The minimum age to purchase tobacco products in Ohio is 21. In December 2019, the United States adopted a law raising the federal minimum age of sale of all tobacco products to 21, effective immediately.

- Establishments are required to post signs stating that the sale or distribution of tobacco products to minors is prohibited.6

- Minors are prohibited from buying alternative nicotine products, including e-cigarettes.6

Local tobacco Laws

- 22 cities in Ohio, including Cincinnati and Cleveland, prohibit the sale of tobacco products those under 21.10

Quitting statistics and benefits

Quitting statistics in Ohio

- The CDC estimates 48.4% of daily adult smokers in Ohio quit smoking for one or more days in 2017.3

- In 2014, the Affordable Care Act required that Medicaid programs cover all tobacco cessation medications.7**

- Ohio’s state quit line invests $1.25 per smoker, compared to the national average of $2.21.7

- Ohio does not have a private insurance mandate provision for cessation.7

Notes and references

Updated April 2019

*National and state-level prevalence numbers reflect the most recent data available. This may differ across state fact sheets.

**The seven recommended cessation medications are NRT gum, NRT patch, NRT nasal spray, NRT inhaler, NRT lozenge, Varenicline (Chantix) and Bupropion (Zyban).

Fiore MC, et al. Treating Tobacco Use and Dependence: 2008 Update. Clinical Practice Guideline. Rockville, MD: US Department of Health and Human Services. Public Health Service: May 2008.

1. CDC, Behavioral Risk Factor Surveillance System, 2017.

2. CDC, Youth Risk Behavior Surveillance System, 2013.

3. CDC, Behavioral Risk Factor Surveillance System, State Tobacco Activities Tracking and Evaluation System, 2017.

4. Campaign for Tobacco-Free Kids, Broken Promises to Our Children: a State-by-State Look at the 1998 State Tobacco Settlement 20 Years Later FY2019, 2018.

5. Campaign for Tobacco-Free Kids, Toll of Tobacco in the United States.

6. American Lung Association, State Legislated Actions on Tobacco Issues (SLATI).

7. American Lung Association, State of Tobacco Control, 2019.

8. Campaign for Tobacco-Free Kids. State Cigarette Excise Tax Rates & Rankings. https://www.tobaccofreekids.org/assets/factsheets/0097.pdf.

9. Public Health Law Center. U.S. E-Cigarette Regulation: 50-State Review. http://www.publichealthlawcenter.org/resources/us-e-cigarette-regulations-50-state-review.

10. Campaign for Tobacco-Free Kids. States and Localities that have Raised the Minimum Legal Sales Age for Tobacco Products to 21. https://www.tobaccofreekids.org/assets/content/what_we_do/state_local_issues/sales_21/states_localities_MLSA_21.pdf.

More in smoking by region

Want support quitting? Join EX Program

By clicking JOIN, you agree to the Terms, Text Message Terms and Privacy Policy.

Msg&Data rates may apply; msgs are automated.